| Brochure.pdf | |

| File Size: | 380 kb |

| File Type: | |

We are an independent broker for Professional Employer Organizations.

We work for the client, not the PEO. While all PEOs perform the same payroll functions, there are differences in services and that is why we assess each client’s needs and select PEOs that would best suit those needs to get proposals. The PEO looks at the worker’s compensation codes, the loss history and the annual payroll amounts to assess the risk and will give us a quote based on this history.

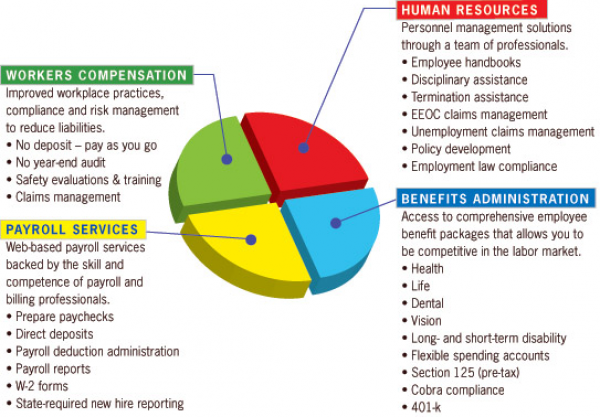

The relationship between a PEO and a client company is a co-employment arrangement. The client retains ownership of the company and control over its operations. The PEO will assume responsibilities and liabilities associated with payroll, payroll taxes, workers’ compensation and benefits. In general terms, the PEO will focus on employment-related issues and the client will be responsible for the actual business operations.

The PEO quotes a percentage for each workers’ compensation code. This percentage includes the employers’ portion of the FICA, FUTA, SUTA, workers’ compensation premium and an administration charge to perform this service. We negotiate the best rates and continue to monitor those rates so that as you grow your business we can renegotiate after a growth trend has been established. The bottom line can be a cost savings due to the PEO’s size and expertise in managing these functions.

Workers’ compensation is pay as you go. You will not have an upfront deposit nor will you have an end of the year audit. The PEO will take care of your workers’ compensation claims for you. Normally, we negotiate a deductible to keep the rates down and this incentivizes good safety practices. Safety management is another benefit provided by the PEO.

The PEO gives you a full payroll service: paychecks, direct deposits, payroll reports, assumes liability and files payroll taxes, W-2 forms, and state required new hire reporting.

While you retain the responsibility of hiring and terminating employees, the human resource department will be available to offer guidance through the mine field of employment law. They also handle your unemployment claims.

If you choose to offer benefits, most PEOs have a comprehensive benefit package. We will select the PEO whose benefit package best meets your needs.

The relationship between a PEO and a client company is a co-employment arrangement. The client retains ownership of the company and control over its operations. The PEO will assume responsibilities and liabilities associated with payroll, payroll taxes, workers’ compensation and benefits. In general terms, the PEO will focus on employment-related issues and the client will be responsible for the actual business operations.

The PEO quotes a percentage for each workers’ compensation code. This percentage includes the employers’ portion of the FICA, FUTA, SUTA, workers’ compensation premium and an administration charge to perform this service. We negotiate the best rates and continue to monitor those rates so that as you grow your business we can renegotiate after a growth trend has been established. The bottom line can be a cost savings due to the PEO’s size and expertise in managing these functions.

Workers’ compensation is pay as you go. You will not have an upfront deposit nor will you have an end of the year audit. The PEO will take care of your workers’ compensation claims for you. Normally, we negotiate a deductible to keep the rates down and this incentivizes good safety practices. Safety management is another benefit provided by the PEO.

The PEO gives you a full payroll service: paychecks, direct deposits, payroll reports, assumes liability and files payroll taxes, W-2 forms, and state required new hire reporting.

While you retain the responsibility of hiring and terminating employees, the human resource department will be available to offer guidance through the mine field of employment law. They also handle your unemployment claims.

If you choose to offer benefits, most PEOs have a comprehensive benefit package. We will select the PEO whose benefit package best meets your needs.